Briefing document for Minister Shane Ross on Dublin Port’s new cruise ship berthing and pricing policy

21 March 2019

Dublin Port’s cruise business

1. There were 7,969 ship arrivals into Dublin Port in 2018. 150 of these were cruise ships.

2. Financially, cruise is a small part of Dublin Port’s business:

3. Cruise is also a small part of overall tourism volumes:

– Ireland: 9.9m visitors in 2017 (CSO); 265,000 cruise visitors in all ports (CSO)

– Dublin: 6.4m in 2018 (Fáilte Ireland); 197,000 cruise visitors in Dublin Port (DPC)

Cargo has grown and is the priority

4. Dublin Port has seen 36% growth in cargo volumes in the six years to 2018

5. Unitised freight accounts for 82% of Dublin Port’s volume.

6. Dublin, in turn, accounts for 84% of Ireland’s unitised freight volumes. See Table 1.

7. From 2021, unitised freight volumes in Alexandra Basin will increase greatly.

ABR Project reaches a critical point in Alexandra Basin in 2021 (see Figure 2)

8. Two thirds of all cruise ships berth in Alexandra Basin.

9. As part of the Alexandra Basin Redevelopment (ABR) Project, Seatruck will move its Ro-Ro freight business to Alexandra Basin in Q1 2021.

10. Seatruck had 1,385 arrivals in 2018 equivalent to 17% of all arrivals in that year.

11. This greatly increased volume of shipping activity in Alexandra Basin will be operationally challenging with large numbers of cruise and other ship arrivals for existing trades (Ro-Ro; bulk ships; car carriers).

12. Seatruck’s volume in 2018 was 265,000 units.

13. This is more than twice the Ro-Ro freight volume in Rosslare (129,000 units on 1,770 arrivals in 2017).

14. CLdN operates its container and trailer Ro-Ro business from Ocean Pier in Alexandra Basin. This accounts for 40% of all units moved between Dublin Port and Continental Europe. (Container shipping lines such as BG Freight, ICG’s Eucon and Samskip carry the remaining 60%).

15. Moving Seatruck to Alexandra Basin is critical to allow the redevelopment of Ro-Ro berths and terminal areas for Irish Ferries and Stena Line in the eastern end of the port without disrupting their businesses.

16. As Seatruck moves, existing CLdN cargo will be displaced onto Ocean Pier leaving very limited quayside space for cruise ships.

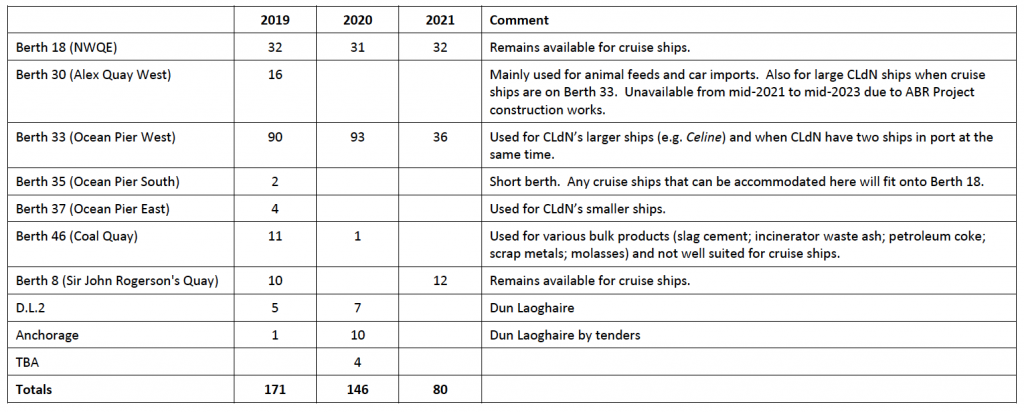

17. Figure 3 shows the new jetty being constructed in Alexandra Basin to which Seatruck will move in 2021.

Brexit implications

18. The volume of freight moved on direct services between Dublin Port and Continental Europe is already 2.4 time greater than moves over the UK landbridge. See Table 2.

19. After Brexit, it is expected that volumes on direct services to Continental Europe will increase. In this context, the CLdN service in Alexandra Basin is particularly important.

20. Because of Brexit, DPC will lose more than eight hectares of land leaving no spare land for temporary cruise terminal facilities for turnaround calls from 2021.

Alexandra Quay West under construction for up to three cruise seasons from 2021 to 2023

21. As part of the ABR Project, Alexandra Quay West will be under construction for at least two years spanning three cruise seasons from 2021 to 2023.

22. During this period, all ships that would normally be worked there will relocate to Berth 33 on Ocean Pier West (which is the main berth on which large cruise ships are currently handled).

23. The allocations of berths for cruise ships from 2019 to 2021 as set out in the new berthing and pricing policy is explained in Table 3.

24. The locations of the berths named in Table 3 are shown in Figure 2.

Two year lead time for allocating berths for cruise ships

25. For 2019 and 2020, the bookings for cruise ships have already been agreed.

26. For 2021, we are currently finalising bookings in accordance with the recently published berthing and pricing policy.

27. Cruise berth allocations for 2022 will be finalised by end 2019.

28. Cruise berth allocations for 2023 will be finalised by end 2020.

29. The objective of this policy is to ensure we don’t accept too many bookings in future years and prevent construction works commencing on Alexandra Quay West.

30. After 2023 when works on Alexandra Quay West are completed, it will be possible to again increase the number of cruise ships back towards 150. The extent to which this will be possible will be determined by the growth in cargo volumes between now and then.

31. The period from 2023 to 2025 will be an interim period to rebuild cruise volumes ahead of the development of North Wall Quay Extension.

New cruise berths on North Wall Quay Extension available from 2026

32. DPC has planning permission from An Bord Pleanála to construct new berths for cruise ships on North Wall Quay Extension (Berths 18 to 25) post 2023 as part of the ABR Project.

33. DPC’s policy in relation to the investment to build these new berths is set out in Masterplan 2040 as follows:

The Port recognises that new cruise facilities will be required to further develop this business and cater for future growth prospects. The Company believes that the consented option of redeveloping North Wall Quay Extension best meets the objective of growing Dublin’s cruise tourism business to its maximum potential.

The main attraction of the cruise industry is the generation of significant revenues for the Dublin region – the actual contribution to DPC’s revenues is not significant. Accordingly the Port could part fund the development but additional funding would be needed from other sources given the scale of capital funding required and the requirement for DPC to demonstrate a return on capital invested. DPC will engage with Dublin City Council (DCC), Fáilte Ireland, the Department of Transport, Tourism and Sport (DTTAS) and other potential funders (both private sector and public sector) on the financing of the project to redevelop North Wall Quay Extension.

34. The redevelopment of North Wall Quay Extension to provide cruise berths is the subject of an economic cost-benefit analysis study by Indecon / Bermello Ajamil which DPC will publish and consult on in mid-2019.

35. Investment by DPC requires third party financial support as has happened in other large cruise ports such as Barcelona.

36. A key part of the consultation will be to determine the cruise industry’s appetite to:

a) Sufficiently guarantee cruise ship calls and revenues to DPC for up to ten years so as to de-risk DPC’s large capital investment (in the order of €100m).

b) Agree that all cruise ships on NWQE will use shore power when at berth and turn off on-board diesel generators to reduce potential air pollution.

37. A second part of the consultation will focus on potential co-funding by the State of the investment based on the wider economic benefits it would generate.

Planned cruise volumes from 2019 to 2026

38. DPC has actively supported the growth of Dublin’s cruise business in recent years (see Figure 1).

39. In particular, in the three years from 2018 to 2020, there are large cruise turnarounds with an average of 25,000 passengers disembarking and 25,000 embarking in Dublin in each season.

40. As a result of this development of the cruise business in Dublin, DPC has achieved proof of concept that Dublin Port can sustain a major cruise business with large numbers of valuable turnaround passengers.

41. There are four phases to realising this potential:

You can download the full briefing document here:

Table 1: Ro-Ro freight volumes in Irish Ports, units 2017

Table 2: Unitised freight volumes in Dublin Port, 2017

Figure 1: Number of cruise calls to Dublin Port, 2006 to 2020

Table 3: Berths to be used for cruise ships in 2019, 2020 and 2021

Figure 2: Location of berths in Dublin Port

Figure 3: New Ro-Ro jetty for Seatruck under construction in Alexandra Basin